Improving your credit score in Singapore is vital for securing loans, obtaining favorable interest rates, and enhancing your financial opportunities. This guide offers key strategies for improving your creditworthiness and maintaining a stellar credit score.

Importance of a Good Credit Score

A good credit score eases access to credit facilities and favorable loan terms. It indicates to lenders your low-risk status, potentially leading to better interest rates and higher credit limits. Ensure timely bill payments and manage your credit applications wisely to maintain an excellent credit rating.

Understanding Credit Reports and Credit Scores

What is a Credit Report?

A credit report in Singapore is a detailed record of your credit history, including loans, repayments, and risk grades, compiled by Credit Bureau Singapore (CBS).

It contains personal information, credit inquiries, and financial data, crucial for lenders assessing credit applications. These reports help lenders make informed decisions on loans, ensuring credit is extended responsibly.

What is a Credit Score?

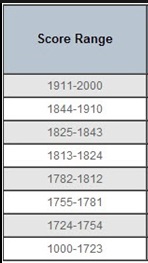

A credit score is a numerical representation of your creditworthiness, ranging from 1000 to 2000, based on your financial activities and credit history. High scores indicate reliability, while low scores suggest a higher risk of default.

Credit scores play a critical role in the approval process for loans and credit terms, determined by authorized credit bureaus like CBS and DP Credit Bureau.

Difference Between Credit Reports and Credit Scores

While both credit reports and credit scores provide valuable insights into an individual’s financial behavior, they serve different yet complementary purposes. A credit report is a detailed document, outlining the credit payment history from various providers and encompassing sections like personal details and credit inquiries.

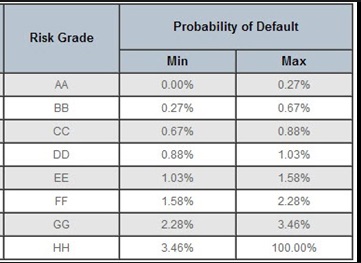

On the other hand, a credit score is a distilled numerical indicator of creditworthiness usually graded from AA to HH.

The credit report offers a chronological record of one’s financial dealings, including any default records, late payments, and overall credit payment history. Conversely, the credit score represents a summarized version of the credit score determined one’s financial health over a specified period of time, facilitating a quick assessment of credit risk.

Lenders utilize the information found in credit reports to delve into an applicant’s financial past and habits whereas, the credit score serves as a swift metric to benchmark the level of risk associated with a borrower and financial institution.

Navigating the nuances between a credit report and a credit score is pivotal in managing one’s financial health and securing access to credit opportunities within Singapore’s competitive financial market.

Factors that Affect Your Credit Score

In Singapore, several variables play a part in determining one’s credit score—a numerical expression of creditworthiness crucial for obtaining credit facilities.

Understanding these factors can equip individuals with the knowledge vital for improving their ratings over time. Here, we delve into the key elements that are influential in shaping credit scores.

Credit Account History

Your credit history demonstrates reliability to lenders. Timely payments signal responsible financial management, boosting your credit score, while late payments or defaults can severely damage it. A consistent history of on-time payments showcases your creditworthiness.

Credit Utilization

Credit utilization is the ratio of your credit balance to your limit, with an optimal ratio being below 30-40%. High utilization suggests overreliance on credit and can lower your score. Maintaining lower balances relative to your limits supports a healthy score.

Length of Credit History

A longer credit history provides a clearer picture of your financial behavior, positively affecting your score. The age of your oldest account and the average age across all accounts are significant, as they demonstrate a long-term pattern of timely payments.

Types of Credit Used

Diversifying your credit (e.g., credit cards, personal loans, home loans) can positively impact your score. A mix of well-managed credit types signals to lenders your adeptness at handling various credit responsibilities.

New Credit

Frequent applications for new credit can lower your score, portraying you as potentially financially distressed. Each application can slightly decrease your score, so it’s important to apply for new credit judiciously.

Optimizing these factors through responsible credit use, maintaining a solid payment history, and being strategic about new credit applications can significantly improve your financial profile in Singapore.

Steps to Improve Your Credit Score

Improving your credit score requires dedication and the implementation of strategic financial habits. By addressing the factors that most significantly affect your credit rating, you can slowly but surely improve your creditworthiness and enhance your financial future.

Below are essential steps to consider in your journey to a stronger credit profile.

Check Your Credit Report Regularly

One of the first steps toward improving your credit score is to have a clear understanding of what is included in your credit report. Obtain your free annual credit report from the Credit Bureau Singapore and examine it meticulously for any inaccuracies or discrepancies.

Keep an eye out for unfamiliar credit inquiries, accounts that you did not open, and ensure all your payment histories are correctly listed.

If you find errors, act swiftly to dispute them as they can unfairly lower your credit score. Regular monitoring of your credit report is a proactive measure that can keep your credit health in check and signal early warnings of identity theft.

Pay Your Bills on Time

Your payment history is a critical component of your credit score. Delays of more than 30 days in settling bills can categorize you as a delinquent borrower, which significantly tarnishes your credit standing. To avoid such implications, always pay your bills punctually.

This includes credit card bills, loan installments, and even utilities and other recurring obligations. Should you encounter financial challenges that impede timely payments, communicate proactively with your lenders to negotiate alternative repayment schemes.

This approach can avert late payment records on your credit report and maintain a positive credit score healthy for you.

Plan & Manage Your Credit Utilization Ratio

Your credit utilization ratio—the amount of credit you are using as compared to the credit available to you—should ideally be kept below 30-40 percent. If possible, aim even lower to reflect a comfortable financial buffer. To achieve this, assess the need for each of your existing credit cards.

Closing unused accounts can simplify your financial landscape and potentially boost your score, but be cautious as this might shorten your average credit age.

Focus on distributing charges across your cards to manage utilization ratios effectively and pay off balances in full to avoid accumulating interest.

Avoid Opening Too Many Credit Accounts

Apply caution when considering new credit lines. Opening multiple credit accounts within a short time frame can damage your credit score as it raises your credit inquiry count and might portray you as credit hungry.

Keep your number of credit cards to a manageable level, such as two or three, to streamline management and avoid the pitfalls of overleveraging.

Additionally, fewer accounts mean saving on potential annual fees and presenting a more stable financial profile to lenders and credit bureaus, which can positively influence your credit score over time.

Resolve Any Outstanding Balances

Leaving balances unpaid can seriously harm your credit score and render you less attractive to potential lenders. An outstanding balance exceeding $300 may plummet your your credit score risk grade onegrade to HZ, reflecting significant risk to lenders and damaging your borrowing ability.

To prevent this, make it a priority to reduce and eliminate any outstanding balances. Settling debts not only improves your credit score but also alleviates the stress that comes with debt burden, paving the way for healthier financial management.

Seek Credit Counselling Services

If managing your debt feels overwhelming, EDUdebt, a premier credit consolidation service, offers personalized guidance and support. Our experienced counselors are dedicated to helping you structure your debts and develop tailored repayment plans that fit your unique financial situation.

By working with a credit counseling service, you benefit from professional advice aimed at managing your finances to repay loans more effectively and improving your credit score. Such services also offer a chance to explore debt management programs and can prevent the long-term consequences of defaulting on loans.

Maintaining financial discipline, such as paying bills and loans on time and keeping credit utilization low, is essential for a good credit score.

Regularly reviewing your credit report, limiting credit applications, resolving outstanding debts, and using credit counseling services when needed are all prudent strategies to keep bad credit scoreemploy.

Following these steps diligently over time can help to rebuild a healthy credit score through repayment programs and navigate a clearer path to debt freedom in Singapore.

Discover how EDUdebt’s can help to rebuild a healthy credit score for you.

Applying for Credit Facilities

Understanding and improving your credit report and score are essential steps before applying for loans or credit facilities. A higher credit score enhances your borrowing capacity, enabling access to larger loans and better terms.

Tips for a Successful Loan Application From Financial Institutions

- Maintain a clean payment history.

- Limit credit inquiries and maintain old credit lines for a longer credit history.

- Discuss any financial difficulties with lenders early to find solutions.

- Simplify your credit facilities by keeping only necessary accounts

How to Maintain a Good Credit Grade

Live within your means and manage your credit responsibly. Timely payments, sensible credit utilization, and a strategic approach to new credit applications will help you maintain a high credit score, paving the way for financial stability and success.

If you have more questions, click this button to schedule a session on how we can help you.

One Response