Discharged Bankrupts Clarification

In Singapore, discharged bankrupts can pursue credit cards, but with certain criteria to meet.

They must approach a credit or debit card or issuer, providing proof of discharge and demonstrating a stable income that meets the issuer’s minimum requirement.

However, not all issuers extend services to discharged bankrupts, so applying to multiple issuers increases approval chances.

Moreover, there may be limitations or conditions placed on the credit cards issued to discharged bankrupts. These limitations can include lower credit limits, higher interest rates, and restricted access to certain privileges or rewards programs. These conditions are imposed to mitigate the higher risk associated with lending to individuals who have previously been declared bankrupt.

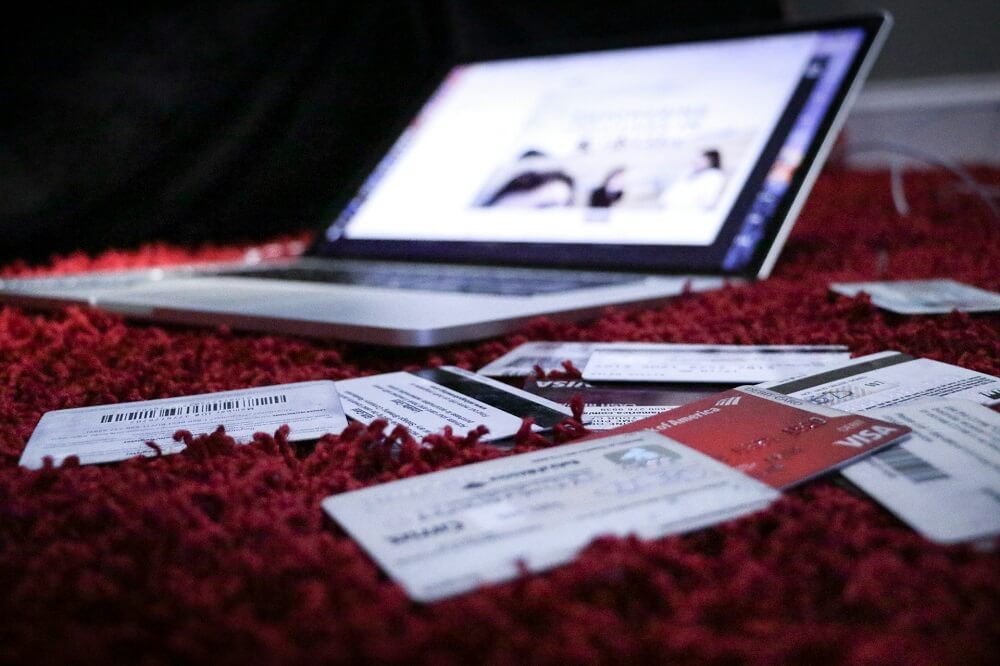

Importance of credit cards in Singapore

Credit cards are vital in Singapore for managing expenses and online transactions, but individuals with poor credit face hurdles in obtaining them.

Poor credit stems from missed payments or loan defaults, limiting access to credit. Credit cards help build a positive credit history, crucial for future financial endeavors like loans or mortgages.

Secured credit cards offer a path to rebuild credit. They require a security deposit, reducing risk for issuers, and making them accessible to those with poor credit.

In essence, credit cards offer convenience and flexibility in Singapore. Secured cards are a tool for rebuilding credit and establishing a positive financial history, requiring careful selection to align with one’s needs.

Overview of Credit Cards for Discharged Bankrupts

Definition of discharged bankrupt

A discharged bankrupt refers to an individual who has been legally released from their financial obligations by a court due to insolvency. This means that, after completing a bankruptcy process, a bankruptcy order, the bankruptcy provided the person is no longer legally bound to repay the debts they owed.

As a discharged bankrupt, certain responsibilities and rights come into play during legal process. Firstly, it is essential to understand that discharged bankruptcy does not completely wipe away the financial history or credit record. The bankruptcy filing may remain on the individual’s credit report for a specified period, which can vary by jurisdiction.

One of the key responsibilities of a discharged bankrupt is to fulfill their obligations to the creditors representing the bankruptcy estate to the best of their ability. They must cooperate with the bankruptcy trustee, provide accurate financial information when required, and report any changes in their circumstances.

Additionally, they are expected to disclose any assets acquired during the period of bankruptcy or after discharge.

On the other hand, a discharged bankrupt also possesses certain rights. They have the right to start fresh and rebuild their financial life. They may apply for credit, seek employment, and engage in economic activities without being discriminated against solely based on their past bankruptcy status.

Furthermore, they have the right to take legal action to dispute any inaccurate information relating to their bankruptcy that may appear on their credit report.

In conclusion, a discharged bankrupt is an individual who has completed a bankruptcy process and is relieved from most of their financial obligations. Although they must fulfill specific responsibilities, such legal actions such as cooperating with the bankruptcy trustee, they also possess rights to establish their financial stability again.

Eligibility criteria for credit cards in Singapore

Eligibility criteria for credit cards in Singapore may vary slightly among different banks and financial institutions. Generally, to qualify for a credit card, an individual must be at least 21 years old and have a stable source of income. The minimum income requirement typically ranges from S$30,000 to S$80,000 per year, depending on the bank and the type of credit card.

When it comes to credit scores total debt amount, bankruptcy can have a significant impact. In Singapore, bankruptcy remains on an individual’s credit report for five years. During this period, obtaining credit cards or any form of credit can be extremely challenging. Banks see bankrupt individuals as high-risk borrowers and are often hesitant to approve their credit card applications.

Fortunately, even individuals with less-than-stellar credit have options in Singapore. Some banks offer secured credit cards, which require a cash deposit as collateral. These cards are a good starting point for rebuilding credit.

Additionally, there are also credit cards specifically designed for individuals with poor credit scores or a bankruptcy history. These cards usually have higher interest rates and fees, but they provide an opportunity for individuals to regain financial stability.

In conclusion, to be eligible for credit cards in Singapore, one must meet the minimum age requirement and have a stable income. Bankruptcy can severely impact credit scores and make it difficult to obtain credit cards. However, there are options available for individuals with less-than-stellar credit, such as secured credit cards or specialized credit cards for those with a bankruptcy history.

Understanding Credit Rating and Credit Reports

Impact of bankruptcy status on credit score

Bankruptcy can have a significant impact on one’s credit score. When an individual files for bankruptcy, it typically remains on their credit report for seven to ten years, depending on the type of bankruptcy. During this time, obtaining credit becomes quite challenging.

Applying for a credit card after declaring bankruptcy can result in a slight drop in the credit score due to a hard credit check. Lenders perform hard credit checks to assess the creditworthiness of individuals seeking credit. Although a single hard credit check may not significantly affect the credit score, multiple inquiries within a short period can cause more harm.

Moreover, post-bankruptcy, there are restrictions on obtaining credit over $1,000. This arises from the lenders’ hesitation to lend more money to individuals with a history of bankruptcy. However, there are ways to slowly rebuild credit. One such method is obtaining small personal loans and consistently repaying them on time. This demonstrates responsible credit behavior and gradually helps in rebuilding creditworthiness.

Certain keywords that can be included in the discussion are “impact of bankruptcy,” “credit scores,” “applying for a credit card,” “hard credit check,” “restriction on obtaining credit,” and “rebuilding credit avoid bankruptcy.” These keywords help in addressing the specific aspects related to the impact of bankruptcy on credit scores and how to rebuild credit after bankruptcy.

Importance of credit reports for discharged bankrupts

Credit reports are tremendously important for individuals who have been discharged from bankruptcy. After a bankruptcy discharge, rebuilding credit becomes paramount, and credit reports serve as a vital tool in this process.

One of the key ways to address the next heading is by explaining that credit reports play a crucial role in rebuilding credit after bankruptcy. They provide a detailed record of an individual’s credit history, including any past bankruptcies. This information is vital to lenders and creditors, as it helps them assess the risk associated with extending credit to someone who has previously filed for bankruptcy.

Actively monitoring one’s credit is of utmost significance for discharged bankrupts. By regularly checking their credit reports, individuals can ensure the accuracy of the information and identify any errors or discrepancies promptly. This allows for timely correction of any inaccuracies, which could potentially harm their credit rebuilding efforts.

In addition to monitoring, actively managing credit is another essential aspect. By responsibly using credit and diligently repaying debts, discharged bankrupts can demonstrate improved financial stability and responsibility to potential lenders. This over time can positively impact their credit score and overall creditworthiness.

In conclusion, credit reports hold a significant importance for individuals who have been discharged from bankruptcy. They allow for the rebuilding of credit and play a vital role in actively monitoring and managing one’s credit.

By understanding the importance of credit reports and taking necessary steps to address their contents, discharged bankrupts can work towards a stronger and brighter financial future together.

Secured Credit Cards for Discharged Bankrupts

Benefits of secured credit cards

A secured credit card is a type of credit card that requires collateral in order to be approved. Unlike traditional credit cards, which are issued based on the applicant’s creditworthiness, secured credit cards are accessible to individuals with limited or poor credit history. As such, these cards serve as a means for individuals to establish or rebuild their credit.

The way secured credit cards work is simple: the cardholder must first provide a security deposit to pay the credit card issuer, typically equal to the credit limit on the card. This security deposit acts as collateral in case the cardholder fails to make payments. The credit limit on secured credit cards usually ranges from a few hundred to a few thousand dollars, depending on the amount of the security deposit.

The main benefit of secured credit cards is that they offer individuals an opportunity to improve their credit scores. By making timely payments and keeping a low utilization ratio, cardholders can demonstrate responsible credit behavior, which eventually helps them qualify for unsecured credit cards and obtain better loan terms.

Secured credit cards also provide the convenience of a credit card, allowing users to make purchases online, rent a car, or make hotel reservations. Additionally, they offer fraud protection and can help build good payment habits. Overall, secured credit cards are an excellent tool for establishing or rebuilding credit and providing financial flexibility.

How secured credit cards work for discharged bankrupts

Secured credit cards can serve as a useful tool for discharged bankrupts in Singapore to rebuild their credit history. These cards require a fixed deposit account as collateral, mitigating the risk for the credit card provider.

To apply for a secured credit card, discharged bankrupts need to open a fixed deposit account with a bank. This requires a minimum deposit, usually ranging from S$500 to S$10,000, depending on the bank and the applicant’s creditworthiness. The fixed deposit is then held as security against the credit card limit.

After the fixed deposit account is opened, the discharged bankrupt can apply for a secured credit card, typically with a credit limit amounting to 80-90% of the fixed deposit amount. This enables cardholders to establish a credit limit suited to their financial means.

Secured credit cards offer discharged bankrupts the opportunity to demonstrate responsible credit behavior and rebuild their creditworthiness over time. To do so, they must make timely payments and keep their credit utilization low. Consistent repayment behavior can gradually improve their credit score and increase the likelihood of accessing standard credit products in the future.

In conclusion, secured credit cards provide discharged bankrupts in Singapore with an avenue to rebuild their credit history. By establishing a fixed deposit bank account and maintaining good credit habits, these individuals can take significant steps towards regaining financial stability.

Applying for a Secured Credit Card

Applying for a secured credit card is a practical way to build or rebuild credit. Unlike traditional cards, secured ones require a security deposit, setting the credit limit. This ensures repayment. We’ll outline steps, including choosing an issuer, determining a deposit, completing the application, and understanding terms. By following these steps, individuals can establish a solid credit foundation.

Process of applying for a secured credit card

Applying for a secured credit card involves several steps. First, find a bank offering secured cards and obtain the application form. Provide personal information like name, contact details, and ID documents, along with financial details such as income and expenses.

You’ll also need to open a fixed deposit account as collateral, typically with a minimum deposit of around S$10,000. Submit the completed form with supporting documents. The bank will review your application, conduct a credit check, and issue the secured credit card if approved.

Ensure you meet all requirements to improve approval chances.

Required documents for discharged bankrupt applicants

When applying for a credit card in Singapore as a discharged bankrupt applicant, certain documents are required to support the application. Firstly, it is important to note that bankruptcy proceedings must be fully discharged before individuals can apply for a new credit card.

For individuals who have completed a Chapter 7 bankruptcy, the following documents are typically required: proof of discharge from bankruptcy, such as a Certificate of Discharge issued by the Official Assignee or the Court, and a letter from high court or the official assignee’s office applicants’ trustee affirming the successful completion of the bankruptcy proceedings.

In the case of individuals undergoing Chapter 13 bankruptcy, approval from the court may be necessary to apply for a credit card. Additionally, documents such as a court order allowing the application and a letter from the trustee stating their support may be required.

It is crucial to abide by these requirements and ensure that all necessary documents are submitted accurately and promptly. Banks or financial institutions will carefully review the documents before deciding whether to accept or reject the application. Failure to provide the necessary documents may result in a denial of the credit card application.

Factors Considered by Financial Institutions

When evaluating a person’s financial situation, financial institutions take into account several factors to determine their overall financial stability. These factors include income, expenses, assets, liabilities, and credit history.

Income

Crucial for determining repayment ability and overall financial capacity. A stable income positively influences credit decisions.

Expenses

Ratio of expenses to income helps evaluate financial management. High expenses or debt-to-income ratio can affect credit eligibility.

Assets

Value and liquidity of assets serve as collateral for loans. Real estate, vehicles, or investments provide security and increase loan approval chances.

Liabilities

Analysis of outstanding loans, credit card balances, and other debts to understand financial obligations. High liabilities may impact debt management and financial stability.

Credit History

Examination of credit score, payment history, and past defaults or late payments. A good credit history indicates creditworthiness and increases chances of credit approval.

In conclusion, financial institutions consider several factors such as income, expenses, assets, liabilities, and credit history to evaluate a person’s financial situation and determine their financial stability. These factors help financial institutions make informed decisions regarding credit approvals and ensure responsible lending practices.

If you have more questions, click this button to schedule a session on how we can help you.

2 Responses